Recording Trades vs. Analyzing the Trade Journal

Many traders make the mistake of only recording their trades—logging entries, exits, and profits—but never taking the time to actually analyze the journal. Keeping a journal without reviewing it is like gathering puzzle pieces but never assembling them.

Recording Trades

- Simply documenting buy/sell orders, price levels, and P&L.

- Acts as a historical reference but lacks analytical depth.

Analyzing the Trade Journal

- Identifying patterns in winning and losing trades.

- Recognizing psychological triggers affecting decisions (fear, greed, hesitation).

- Spotting inefficiencies in execution and improving risk management.

By actively analyzing the trade journal, traders can separate emotional impulses from strategic decisions and refine their approach for better outcomes.

How Learning from Past Trades Can Directly Impact Future Performance

Successful traders don’t rely on luck—they learn from their mistakes and optimize their strategies. Your trade journal is a goldmine of insights waiting to be tapped. By reviewing past trades, you can:

Recognize Your Best Setups – Identify which market conditions and strategies work best for you.

Eliminate Costly Mistakes – Spot recurring errors in execution, such as premature exits or overleveraging.

Enhance Risk Management – Analyze past drawdowns and fine-tune your position sizing.

Develop Psychological Discipline – Track emotional responses and avoid impulsive trading decisions.

When you consistently analyze the journal, you transition from reactive trading to data-driven decision-making. This not only helps you increase profitability but also builds long-term confidence in your trading strategy.

Setting Up Your Trade Journal for Meaningful Analysis

A trade journal is much more than just a log of your entry and exit points. If you want to gain real insights and improve your trading performance, you need to analyze the trade journal beyond the basic numbers. A well-structured journal allows you to spot weaknesses, refine strategies, and make data-driven decisions. But what exactly should you include in your journal to make it truly effective?

Essential Data Points Beyond Just Entry & Exit Prices

However, successful traders know that real improvement comes from analyzing the journal at a deeper level. Here are some critical data points that can make your journal a powerful tool for growth:

Trade Rationale – Why did you take the trade? Was it based on technical analysis, fundamental news, or market sentiment? Documenting your reasoning helps you determine whether your strategy is sound.

Market Conditions – What was the market environment like when you entered the trade? Were you trading in a trending or ranging market? Was there high volatility? Recognizing market conditions helps you identify which setups work best under different scenarios.

Emotional State – Trading psychology plays a crucial role in success. Were you feeling confident, anxious, or overexcited? Noting your emotions allows you to detect patterns in your behavior and avoid impulsive decisions.

Execution Mistakes – Did you enter too early or too late? Did you follow your stop-loss and take-profit plan? Identifying execution mistakes helps you refine your discipline and avoid costly errors.

By expanding your journal beyond just price levels, you’ll be able to analyze the trade journal with greater clarity and extract valuable lessons from every trade.

Digital vs. Manual Journaling – Which One Suits You?

When it comes to keeping a trade journal, traders have two main options: digital or manual. Each has its own advantages, and choosing the right method depends on your trading style and personal preferences.

Digital Journaling (Excel, Google Sheets, Trading Journal Software)

Easy data tracking and automated calculations.

Ability to generate performance reports and insights.

Ideal for traders who rely on statistical analysis.

Manual Journaling (Notebook, Physical Journal)

Encourages deeper reflection and thought process.

No distractions from screens and digital tools.

Best for traders who prefer handwritten notes and personal insights.

If you’re looking for a structured way to analyze the journal with comprehensive data, digital options may work best. However, if you want a more personal and reflective approach, manual journaling can help you internalize lessons more effectively.

Regardless of which method you choose, the key is to remain consistent. A trade journal is only valuable if you review and update it regularly. The more detailed and structured your journal is, the more insights you’ll gain, helping you refine your strategy, minimize mistakes, and become a more confident trader.

Trade Smarter with Journalio! Track, analyze, and optimize your trades effortlessly!

Identifying Patterns and Biases in Your Trading

One of the most valuable aspects of maintaining a trade journal is the ability to identify patterns in your trading behavior. Many traders repeat the same mistakes without realizing it, leading to unnecessary losses and frustration. By consistently analyzing the trade journal, you can recognize recurring errors, distinguish successful strategies from failing ones, and gain awareness of psychological biases that impact your decision-making.

Spotting Recurring Mistakes in Trade Execution

Mistakes in trade execution can significantly affect your overall profitability. While some errors may seem minor at the moment, they can accumulate over time and create long-term inefficiencies. When you analyze the journal, look for these common execution mistakes:

Premature Exits – Are you cutting your winning trades too early out of fear?

Ignoring Stop Losses – Do you let losses run longer than intended, hoping the market will turn in your favor?

Entering Trades Without Confirmation – Are you jumping into positions based on impulse rather than strategy?

Overleveraging – Are you risking too much on individual trades, leading to avoidable large losses?

Recognizing Winning Setups vs. Failing Strategies

Not all trading strategies work equally well under different market conditions. A detailed trade journal analysis allows you to separate high-probability setups from those that consistently lead to losses. Consider tracking:

Best Performing Setups – Identify the market conditions, indicators, and trade triggers that produce your highest success rate.

Losing Trades and Their Common Traits – Look for similarities in failed trades. Are they occurring in choppy markets? Are they executed against the prevailing trend?

Risk-to-Reward Consistency – Are your winning trades significantly larger than your losing trades, or are you taking unnecessary high-risk trades for small rewards?

When you systematically analyze the trade journal, these insights help refine your strategy, allowing you to focus on what truly works while eliminating ineffective approaches.

Understanding Psychological Biases Affecting Your Trades

Your trading decisions are not just based on strategy and analysis—psychology plays a massive role in success or failure. Through analyzing the journal, you can identify emotional patterns that influence your trades, such as:

Overtrading – Are you forcing trades even when market conditions are not ideal?

Revenge Trading – Do you immediately enter a new trade after a loss, trying to recover quickly?

Fear of Missing Out (FOMO) – Are you entering trades late just because you see the price moving fast?

Confirmation Bias – Do you ignore signs that contradict your trade thesis, leading to poor decision-making?

Recognizing these biases is the first step toward overcoming them. By documenting your emotional state in your trade journal, you become more aware of how emotions drive your behavior, allowing you to develop discipline and execute trades more objectively.

Using Data-Driven Metrics to Improve Decisions

Trading is not just about intuition or gut feelings—it’s about numbers, probabilities, and strategy. To become a consistently profitable trader, you need to rely on data-driven insights rather than emotions. One of the best ways to refine your decision-making process is to analyze the trade journal and extract key performance metrics. By understanding these numbers, you can adjust your strategy, minimize risk, and maximize profitability.

Key Performance Indicators (KPIs) Every Trader Should Track

When you analyze the journal, certain key metrics provide a clear picture of your trading performance. These indicators help you understand what’s working and what needs improvement. Here are some of the most critical ones:

Win Rate (%) – The percentage of your profitable trades. While a high win rate is desirable, it’s not the only factor that determines success.

Risk-Reward Ratio (R: R) – The average amount you risk per trade compared to the potential reward. A strong risk-reward ratio (e.g., 1:2 or higher) can compensate for a lower win rate.

Drawdowns – The largest peak-to-trough decline in your trading balance. Monitoring drawdowns helps you manage risk and avoid significant capital loss.

Expectancy – The average amount you can expect to win (or lose) per trade. It’s calculated using both win rate and risk-reward ratio:

Expectancy=(Win Rate×Average Win)−(Loss Rate×Average Loss)

A positive expectancy means your strategy is statistically profitable over time.

By consistently tracking these KPIs in your trade journal, you gain a clearer understanding of your trading edge and where adjustments are needed.

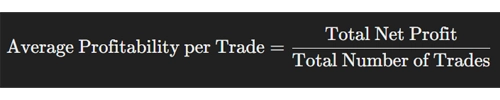

How to Calculate Average Profitability Per Trade & Its Significance

Understanding your average profitability per trade is crucial for evaluating the efficiency of your trading strategy. Here’s how to calculate it:

For example, if you’ve made a net profit of $10,000 over 200 trades, your average profitability per trade is:

This means, on average, each trade contributes $50 to your total profit. A high average profitability suggests that your strategy is effective, while a low or negative value indicates a need for improvement.

When you analyze the trade journal, look for trends in profitability. Are certain trade setups yielding better results? Are there specific conditions where your profits decline? Identifying these patterns helps you optimize your strategy and focus on high-probability trades.

Why Tracking Market Conditions & Trade Performance Correlation is Essential

Market conditions play a huge role in your trading outcomes. Even the best strategies may not work equally well in all market environments. That’s why it’s essential to track how your performance correlates with different market conditions.

Some key factors to consider when analyzing the journal include:

Trending vs. Ranging Markets – Does your strategy perform better in strong trends, or is it more suited for range-bound conditions?

Volatility Levels – Are you more successful in high-volatility environments, or do you struggle when the market is unstable?

News & Economic Events – How do major economic releases (e.g., FOMC, NFP, earnings reports) impact your trade outcomes?

By tracking these correlations in your trade journal, you can refine your approach and adapt your strategy to different market conditions. This helps you avoid unnecessary losses and capitalize on opportunities when the odds are in your favor.

The Role of Psychological and Emotional Analysis in Trading

Trading is not just about numbers, charts, and strategies—it’s a psychological game. Even the most well-planned strategies can fail if emotions take control. Fear, greed, frustration, and overconfidence can all lead to impulsive decisions that sabotage your performance. To achieve long-term success, you need to recognize how emotions impact your trades and develop a disciplined mindset. One of the most effective ways to do this is to analyze the trade journal and track your emotional states throughout your trading journey.

How Emotions Impact Trading Decisions

Emotions influence every aspect of trading. The market doesn’t just test your technical skills—it challenges your patience, discipline, and ability to stay calm under pressure. Without proper emotional control, traders often fall into these common psychological traps:

Fear of Losing (Avoiding Trades or Exiting Too Early) – Fear can prevent you from taking good trades or cause you to close winning trades prematurely, missing out on potential profits.

Revenge Trading – After a loss, frustration can drive traders to take impulsive trades in an attempt to recover quickly, leading to even greater losses.

Overconfidence After Winning Streaks – A series of wins can create a false sense of invincibility, causing traders to take excessive risks and ignore proper risk management.

FOMO (Fear of Missing Out) – Seeing a strong market move can tempt traders to jump in late, often at the worst possible time.

By analyzing the journal, you can identify when emotions are influencing your trading behavior and take corrective action before they lead to major losses.

Master the Market with AryaMerxs! Gain expert insights, refine your strategies, and stay ahead of the competition. Start your journey today!

Tracking Emotional States to Detect Destructive Behaviors

When you analyze the trade journal, ask yourself:

What was I feeling before entering this trade? (Confidence, anxiety, impatience?)

How did I react when the market moved against me? (Stayed calm, panicked, adjusted the trade plan?)

Did emotions cause me to break my rules? (Overtrading, revenge trading, moving stop-losses?)

By tracking emotional trends in your journal, you can detect self-sabotaging behaviors and work toward eliminating them. If you notice patterns—such as consistently making bad decisions after a loss—it’s a sign that emotions, not strategy, are dictating your actions.

Developing a Mindset for Objective Decision-Making

The most successful traders have one thing in common: emotional discipline. They make decisions based on logic and data rather than on impulses. Here’s how you can develop a mindset for objective trading:

🧠 Follow a Strict Trading Plan – A well-defined strategy helps remove emotional biases from your trades.

🧠 Use Pre-Trade Checklists – Before entering a trade, confirm whether it aligns with your strategy instead of acting on impulse.

🧠 Practice Mindfulness & Self-Awareness – Recognize when emotions are influencing your decisions and step back when needed.

🧠 Set Realistic Expectations – Losses are a natural part of trading. Accepting them as part of the process prevents emotional overreactions.

🧠 Review and Analyze the Journal Regularly – By going through past trades and emotional notes, you gain valuable insights into your psychological weaknesses and strengths.

When you consistently analyze the trade journal, you develop self-awareness, improve discipline, and create a structured approach to decision-making. Over time, this allows you to trade with confidence, remove emotional biases, and execute strategies with greater precision.

Leveraging Technology & Automation for Journal Analysis

Technology plays a crucial role in optimizing performance. While manual journaling has its benefits, integrating automation and AI-driven tools can significantly enhance the efficiency and accuracy of trade analysis. Traders who consistently analyze the trade journal using technology can uncover deeper insights, improve decision-making, and refine their strategies with minimal effort.

AI-powered trade Journal Analysis Tools

Artificial intelligence has transformed the way traders track and analyze their performance. AI-powered trade journal analysis tools can process vast amounts of trading data, detect patterns, and generate actionable insights that might take a human trader hours—or even days—to identify. Some key benefits of using AI-driven journal tools include:

Pattern Recognition – AI can identify recurring setups, mistakes, and profitable strategies by analyzing past trades.

Sentiment & Emotional Analysis – Some AI tools assess trading behaviors and highlight emotional biases affecting decision-making.

Performance Forecasting – AI can estimate the probability of success for future trades based on historical data.

Automated Data Visualization – Instead of manually reviewing spreadsheets, AI tools generate performance dashboards with key metrics.

By leveraging AI-powered tools to analyze the journal, traders can gain a competitive edge by making data-backed decisions rather than relying solely on intuition.

Trade Smarter with AryaMerxs AI! Get real-time market insights and optimize your strategies instantly. Start chatting now!

How Automation Can Provide Real-Time Insights

One of the biggest challenges in trade journaling is keeping up with real-time market dynamics. Manual journaling requires traders to log their entries, exits, emotions, and market conditions, which can be time-consuming. Automation solves this issue by providing real-time insights and instant feedback on trade performance.

🔹 Auto-Logging Trades – Many modern platforms automatically record trades, eliminating human error and saving time.

🔹 Instant Risk Analysis – Automation tools assess each trade’s risk-reward ratio and compare it to past trades, helping traders maintain discipline.

🔹 Real-Time Alerts – Some systems notify traders when they deviate from their predefined strategies, preventing emotional or impulsive trades.

🔹 Market Condition Tracking – Automated tools can correlate trade outcomes with market conditions, helping traders adjust their approach based on volatility and trends.

When traders analyze the trade journal with automation, they can quickly identify weaknesses and make necessary adjustments without the delay of manual data entry and review.

The Balance Between Manual Review and Automated Analysis

While automation provides efficiency and real-time insights, manual journaling still holds significant value. The key to a comprehensive trade journal is finding the right balance between technology-driven analysis and human intuition.

✔️ When to Use Automation:

For tracking key metrics like win rate, risk-reward ratio, and expectancy.

For auto-logging trade details and market conditions.

For identifying statistical patterns and execution mistakes.

✔️ When to Rely on Manual Review:

For reviewing emotional and psychological factors that affect decision-making.

For refining subjective elements like trade rationale and market intuition.

For setting long-term improvement goals based on personal insights.

Conclusion

To truly benefit from journaling, traders must go beyond simple record-keeping and turn raw data into actionable insights. By regularly analyzing the journal, you can identify high-probability setups, eliminate recurring mistakes, and optimize your approach to changing market conditions. Tracking emotional responses and trade performance allows you to make objective, data-driven improvements rather than trading on impulse.

The key to long-term success is consistency. Make trade journal analysis a fundamental part of your routine by reviewing it daily or weekly, recording not only technical details but also your mindset and decision-making process. Over time, this habit will refine your trading discipline, helping you execute strategies with greater precision. In the ever-evolving world of trading, those who commit to learning from their past experiences through analyzing the trade journal gain a significant edge over the rest.