Let’s be honest — making mistakes in trading isn’t the real problem. Repeating them is.

In the fast-paced world of charts, candlesticks, and FOMO-fueled decisions, even the smartest traders fall into familiar traps. You tell yourself, “I’ve learned my lesson,” only to realize, three trades later, that you’ve danced to the same emotional tune once again. This not only leads to frustration but also to significant financial losses.

This isn’t about a lack of skill. It’s about a lack of clarity.

Here’s the truth: in trading, your memory is a poor teacher. You think you’ll remember why you entered that late-night trade or what emotion triggered that premature exit, but without a trading journal, it all fades into noise. That’s where the power of reviewing past trades reveals itself — not as a luxury, but as a necessity.

When you document your trades consistently and review them with intent, you stop guessing and start learning. A trading journal serves as a tool for this learning process. Patterns emerge. Emotional triggers become obvious. And most importantly, the feedback loop tightens: mistake → awareness → improvement.

So here’s the big question:

Why do so many traders fall into the same mistakes, even when they know better? This is a question that every trader should ask themselves, and the answer might surprise you. It starts with how (and if) they track their journey.

The answer might surprise you. And it starts with how (and if) they track their journey.

“Supercharge your trading strategy with Journalino – your AI-powered trading journal.

Start tracking smarter, not harder!”

The Modern Trader’s Dilemma

We live in a golden era of trading — access to markets is instant, strategies are a Google search away, and countless YouTube mentors claim to hold the keys to consistent profits. Yet, despite all this, most retail traders are still stuck in a loop of frustration. Why?

Because more data doesn’t mean more insight.

And more trades don’t mean more progress.

The modern trader isn’t just starved for information. They’re drowning in it. Discord groups, Telegram signals, Reddit threads, and indicators layered on indicators — all shout louder than the trader’s voice. In this chaos, self-awareness becomes the first casualty, and the need for a clear, focused approach becomes more evident.

That’s the real dilemma:

You’re making trades, but not making sense of them.

Add to that the psychological pressure of performance, the fear of missing out (FOMO), and the temptation to revenge trade after a loss, and you’ve got a perfect storm for mistakes. Not random mistakes, but repeated ones.

Without a clear mirror to reflect on what went wrong (or right), it’s easy to convince yourself that each trade was an exception, not part of a pattern. And so, the cycle continues: the same emotions, the identical setups, the same outcomes.

What is a Trading Journal?

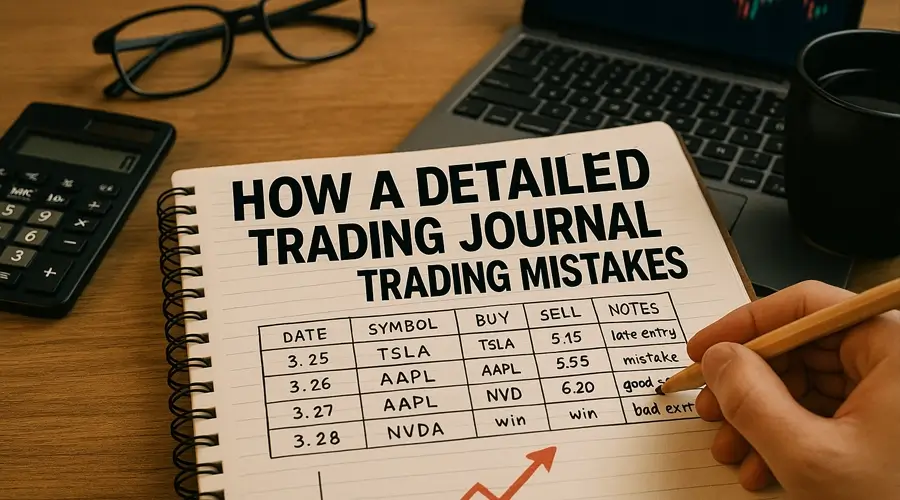

Let’ s get something straight — a trading journal is not just a notebook where you jot down your wins and losses like it’ s some kind of scoreboard. If that’ s all you’ re doing, you’ re not journaling; you’ re merely logging results. And that’ s the difference between recording your trades and learning from them.

A real trading journal is a tool, a mirror, a mentor. It doesn’ t just show you what happened — it reveals why it happened and how you felt when it did. It’ s not a static archive; it’ s a living document that evolves as you do.

Think of it this way: if your trades were chapters in a book, your journal is the story behind them — the thoughts, fears, patterns, and moments of clarity that connect it all.

So, what separates a basic log from a detailed trading journal?

Let’ s break it down into essential elements:

Entry

When and why did you enter the trade? What was the setup? What did the chart indicate? What did your gut say — and did you listen to it?

Exit

Where did you exit — and why? Was it part of your plan, or did fear and greed step in and rewrite the rules?

Reason

Document the logic behind your move. What technical or fundamental cues were you reacting to? This isn’ t about proving you were right — it’ s about making your reasoning visible so you can test it over time.

Emotion

Were you calm? Hesitant? Overconfident? Fearful? Write it down. Emotions are the hidden drivers of many trading decisions, and unless you track them, they’ ll keep leading you straight into mistakes.

Market Context

What was happening in the broader market? Was it NFP day? Was a Fed announcement looming? Understanding your trade in its environment adds depth to your review.

A detailed trading journal isn’ t just about collecting data — it’ s about connecting the dots. Over time, it gives you insight into who you are as a trader, not just how much you’ re making. And that’ s where the real power lies.

Because ultimately, your most consistent edge isn’ t the perfect entry — it’ s the ability to recognize your patterns, refine your process, and evolve with intention. This is where the true power of a trading journal lies, in helping you become more self- aware and improve your trading performance.

And that process begins with a real journal.

The Psychology of Reviewing Past Trades

You can’t improve what you won’t confront.

Every trader has a psychological fingerprint — a set of emotions, impulses, and blind spots that shape how they respond to risk. The challenge? Most of us are so deep in the moment that we can’t recognize our patterns. That’s where reviewing past trades becomes a game-changer — not just for your strategy, but for your mindset.

Let’s be real: emotions don’t show up as numbers on a chart.

They appear as second guesses, rushed decisions, and that quiet voice saying, “Just one more trade to make it back.”

When you look back at your trades — not just the outcome, but the inner landscape of each decision — you start seeing things you couldn’t possibly catch in the heat of the moment. Reviewing past trades gives you psychological distance. And that distance creates perspective.

Why did I enter too early?

Why did I break my stop-loss rule?

Why did I exit right before the move took off?

You’ll start realizing that many of these answers are less about market conditions and more about you. Your fears. Your hopes. Your biases.

And here’s the beautiful part: the more you review, the more self-aware you become. You stop reacting and start responding. You notice patterns not just in price, but in your behavior. You develop what seasoned traders call “emotional discipline.”

In other words, you stop fighting the market and start managing yourself.

Pro tip: When reviewing trades, don’t just ask “Was this a win or loss?”

Ask: What was I thinking? What was I feeling? What would I do differently now — and why?

Over time, this habit has a profound effect.

It rewires your brain from emotional gambler to strategic operator.

And that is where consistent improvement truly begins.

“Boost your trades with ARYAMERX AI Chatbot – faster, smarter decisions in real time.

Start chatting with AI now and trade like a pro!”

Common Trading Mistakes You Catch (Only) With a Journal

Every trader has “that one mistake” they keep making — the one they swear they’ve moved past, until it shows up again… and again. The problem is, most of these mistakes hide behind excuses. You don’t fix them because you don’t see them.

But when you start documenting your trades, the truth shows up in black and white. A trading journal doesn’t lie. It quietly highlights your weak spots, one painful—but—necessary entry at a time.

Here are some of the most common trading mistakes that only become visible when you take the time to review your trades:

Entering Without a Plan

You saw a breakout, got excited, clicked “buy” — and then stared at the screen wondering what your exit strategy was. No preset stop loss. No risk-reward ratio. Just vibes.

Your journal calls this out instantly: “What was the plan here?” If you don’t have one, it’s obvious — and fixable.

Overtrading

This one’s sneaky. You might think you’re being productive, but really, you’re just bored, chasing the thrill. Your trading log will tell you if you’re averaging seven trades a day when your strategy only requires two.

Revenge Trading

Ah, the classic. You took a loss, felt the sting, and decided to “win it back” right away. No analysis, just emotion. A glance at your journal shows you how often this impulse costs you more than the original loss.

Exiting Too Early (or Too Late)

You panicked. Or got greedy. Or you just didn’t trust your setup.

When you log your entry and exit reasons, you begin to see the gap between your system and your behavior.

Ignoring Market Context

You went short right before a major earnings report… again.

A good trading journal reminds you that the market doesn’t exist in a vacuum — and neither should your trades.

Over time, these patterns become crystal clear. And once you see a pattern, you can change it.

You move from “Why does this keep happening?” to “Here’s what I’m going to do next time.”

And that, my friend, is the difference between a trader who wings it and one who wins consistently.

“Master the Market with ARYAMERX – unlock expert insights and trading strategies.

Level up your trading game and stay ahead of the curve!”

From Chaos to Clarity: How a Journal Shapes Strategy

Markets are noisy. Your head? Even noisier.

One day, you’re a breakout trader. Next, you’re scalping reversals on a 1-minute chart. And somewhere along the way, you wonder: “What’s working for me?” That question alone is powerful, but it’s useless without data to support it.

Here’s where a detailed trading journal becomes your lab.

It strips away the chaos and replaces it with clarity. It tells you which setups work consistently, which timeframes suit your rhythm, and — most importantly — where your strategy is bleeding money. It shows you, to you.

How a Journal Helps Shape Your Strategy:

Pattern Recognition

When you journal regularly, patterns start popping. You may win 70% of your trades when entering during the London session, but only 30% in the New York open. That’s not intuition. That’s data talking.

Strategy Filtering

You might love a flashy setup, but your journal shows it’s losing over time—journaling forces you to let go of what feels good and hold onto what works.

Personalization

Forget cookie-cutter strategies from Twitter threads. With a journal, you build a system that leverages your strengths and addresses your weaknesses. Your entries, your mindset, your edge.

Consistency Building

When you track not just the trade but the logic behind it, you build a replicable system. And replicability is what separates pro traders from hobbyists.

The magic? It’s not in finding some holy-grail indicator.

It’s in using your trades as a feedback loop to refine what you already do.

Because when you move from chaotic impulses to data-driven clarity, you’re no longer gambling — you’re evolving. One trade. One journal entry. One insight at a time.

Final Thought

Trading isn’t just about predicting price — it’s about predicting yourself.

A detailed trading journal isn’t a boring routine. It’s your most underrated edge. It’s where emotion meets logic, where habits reveal themselves, and where real growth begins. It’s not about writing for the sake of writing — it’s about building a personal library of experience you can learn from.

Because let’s be real: markets will always be unpredictable.

But you don’t have to be.

By reviewing past trades, you move beyond wishful thinking into intentional improvement. You stop playing defense and start playing smart. You learn from losses without shame, and wins without arrogance.

So, whether you’re journaling with pen and paper or using a slick digital tool, what matters most is consistency. Honesty. Curiosity.

Because every journal entry is more than a trade review — it’s a conversation with your future self.

And that version of you? The calm, clear, confident trader?

They’re built one honest review at a time.